North American oil markets are entering a new an era of insecurity in market access, with major implications for economic, environmental and energy policy. For the past 35-40 years, the insecurities around oil were concerned with its supply, not with market access. That reality drove investments in the development of energy technologies and the protection, by military and political means, of access to oil resources in the Middle East. However, over the past few years, four forces – supply, competition, demand and social license – have been working in concert to propel North America into a new era in which economic, environmental and energy policy will be defined by insecurity in market access. This article explores these forces with a particular focus on the crude oil transportation bottleneck that has developed across United States and Canada.

Read this article in Chinese | Français

Forty years ago, a sharp rise in the price of oil launched North America and much of the world into an era of insecurity in energy supply. While prices did eventually stabilize at a lower level between 1985 and 2005, the U.S. dependence on imported energy steadily rose, such that by 2008, 66% of U.S. oil demand was provided through imports.

The resurgence of global oil prices in the early 2000’s created the conditions for the rapid deployment of a number of new energy technologies that were in development over the preceding decades. This set the stage for a new era of oil in North America.

Figure 1. The history of U.S. domestic oil prices in actual or inflation-adjusted (2011) US dollars

So technological innovation, occurring within an environment of economic opportunity, has altered the supply, competition and demand for oil in North America.

A supply side revolution

After decades of declining North America oil production, the past 5 years have witnessed a sharp rise in production. The U.S. Energy Information Agency (EIA) and Canadian National Energy Board (NEB) have forecasted that U.S. and Canadian production should reach 14.4 Mbbl/d by 2020, compared with only 7.8 Mbbl/d in 2008 (an 85% increase). There are two main reasons for this revolution in North America oil supply:

Shale Oil. Over the past 10 years, innovative companies working with U.S. federal investments brought together two technologies: horizontal drilling and hydraulic fracturing (or “fracking”). The result was unprecedented access to previously inaccessible oil and gas reserves distributed in very-low-permeability reservoirs, including those commonly known as “shale oil” and “shale gas.” According to the EIA, approximately 25.3 billion barrels could be produced cumulatively from 2012 through 2040. However, shale oil wells exhibit their peak production rates during the first few weeks of operation and then decline by 40 to 50% within the first year. These dramatic declines account for the need to drill many new wells to maintain a consistent flow of oil. As an example, in the Bakken formation (the largest shale oil play), about 90 new, producing wells were needed per month to maintain the rate of oil production in 2012 (770 kbbl/d) (source).

Figure 2. The key drivers behind a new era for oil in North America: an Era of Insecurity in Market Access

Figure 2. The key drivers behind a new era for oil in North America: an Era of Insecurity in Market Access

Oil Sands. In contrast to the rapid, shorter-term nature of shale oil wells, the new oil production capacity in Canada requires long term planning, multi-decade investments but they tend to return relatively stable and predictable product yields. Oil sands facilities are capital intensive to establish and energy intensive to operate. They are located in Northern Alberta – a land-locked province far away from the demand centres in North America – and account for the third largest proven oil reserve on earth (EIA).

While Canada’s oil production is expected to grow steadily from 3.4 Mbbl/d in 2012 to 5.8 Mbbl/d in 2035, U.S. oil production is expected to peak at about 9.7 Mbbl/d in 2019 and then slowly decrease. This means that Canada’s crude oil could account for more than 40% of North American oil production in 2035. Nevertheless, this unpredicted oil revolution also brings new challenges in North America, including the need to bring this new domestic supply to market.

Figure 3: History and Forecast of the crude oil supply to meet North American (USA + Canada only) demand

In the U.S., the potential for North American oil self-sufficiency announced by the EIA has reopened the debate on crude oil exports which have been banned by law in the 1970’s. One industry argument is that many refineries have been adapted to process heavier crude oil so they are no longer well-suited to the type of oil being produced by shale oil fields. Recently the Obama administration authorized four companies to broadly export U.S. natural gas. Whether the policy changes or not, North American oil-sufficiency, if achieved, would likely have major implications on global geopolitics, including U.S. military investments in the Middle East and around the world.

Competition in the marketplace

Crude oil use in NA has declined about 1.3% between 2001 and 2011, even though the population has increased by 8.4% over the same period. According to NEB and EIA predictions, the decline is expected to continue and then stabilize at approximately 15 Mbbl/d by 2025. Since the majority of oil use is coupled to transportation fuels in NA (~70% in the U.S.), the primary competition for oil is in the delivery of transportation services. Competition includes:

Biofuels. Ethanol is the fast growing transportation fuel in the U.S. It rose from 2.8% of gasoline supply in 2005 to 9.9% in 2012 (EIA). The growth of this market has largely been driven by regulation and policy, including the U.S. Open Fuel Standard Act (2011) that requires 95% of cars built in 2017 to operate on non-petroleum-based fuels, including ethanol and biodiesel. According to EIA, advanced renewable fuels (i.e those with a 50%+ reduction in GHGs) are expected to continue to grow quickly in the coming decades, from 90 kbbl/d in 2013 to ~550 kbbl/d in 2040.

Natural gas. On an energy content basis ($/GJ), natural gas prices have averaged 77% of the oil price between 1989 and 2005. The situation changed dramatically in the past eight years with the develop and deployment of shale gas technology (similar to shale oil discussed above) The natural gas prices dropped to as little as 15% of the price of oil on an energy basis stimulating interest in using compressed (CNG) or liquefied (LNG) natural gas to power municipal vehicles (buses, garbage trucks), supply chains vehicles, trains, ships and heavy duty trucking. In 2012, the EIA projected that sales of heavy-duty natural gas vehicles could increase to 275,000 by 2035, equivalent to 34% of new heavy-duty vehicles sales.

Natural gas could also compete with oil directly in the diesel and gasoline market by first being converted to those fuels through Fischer-Tropsch synthesis or other gas to liquid (GTL) technologies.

Electric Vehicles. Climate change concerns, coupled with the rising cost of oil have renewed interest in electric vehicles over the past 5 years, especially for personal transportation. Since 2008, more than 172,000 plug-in electric vehicles have been sold in the U.S., helped by federal tax credits and state incentives. A new generation of all-electric and fast charging technologies are being introduced and gaining widespread interest, if not market share. In early 2013, a U.S. Department of Energy study noted that the success of the electric vehicle industry will depend on significant reductions in the cost of the electric drive system (by 75%), the weight of the vehicle (by 30%) and the cost of the batteries (by 75%).

A shrinking demand for transportation services

In the past two to three decades, the rapid development of information and communications technologies have impacted the way people live, interact and do business. Teleworking, videoconferencing, internet marketing as well as cell phone and file sharing technologies have changed the importance of face to face meetings, how retailers and shoppers interact, the nature of socialization and ultimately the role of transportation in society.

This transformation has shaped a new generation, the Y generation, who clearly place personal mobility lower on their priority list than previous generations. Many have suggested that NA has already reached ‘Peak Car’ even though the population continues to rise. As this new generation matures and the mobility needs of the ‘baby boom’ generation decline when they move into retirement, there are likely to be major impacts on urban design, with increasing densification and a lower dependence on personal vehicle transportation that has dominated NA culture for the past 65 years.

Public transit and car sharing are likely to increase in importance, but a transformational change in our transportation needs (and the resulting demand for oil) will likely require the implementation of one or more of the new technologies currently in development. For example, self-driving vehicles could provide a low-cost, on-demand, internet-connected taxi service that will be more cost effective, energy efficient and convenient to use than personal car ownership. In addition, it could free up some of the 30%+ of the land area in cities that is now dedicated to vehicle parking.

A new challenge: connecting domestic supply to demand

The combination of rising supply, greater competition and shrinking demand have created a new challenge for the North America oil industry: how to get the oil from the new centres of supply to markets either within North America or overseas.

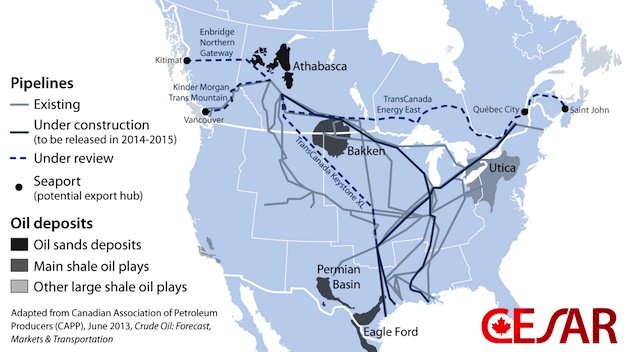

This is especially a challenge for the Canadian oil sands and the Bakken fields of North-western USA (Fig. 4). These are land-locked regions with neither access to tidewater nor sufficient pipeline capacity to bring current and projected levels of production to refineries located in the U.S. Midwest and Gulf Coast.

Figure 4: Map of existing, under construction & proposed oil pipelines in North America and their relationship to the major new unconventional oil deposits being developed

Not surprisingly, the past few years have seen numerous new applications for oil / bitumen pipelines to provide ‘take-away’ capacity. These include:

TransCanada Keystone XL Pipeline. If approved, this pipeline will provide a connection between the hubs of Hardisty Alberta and Steele City, Nebraska where it can flow to numerous refineries. The decision on this matter currently rests with President Obama.

Canada East Pipeline. While Canada produces about twice as much oil as it uses nationally, refineries in Quebec and Atlantic Canada still rely on oil imported from the USA or from tankers on the Atlantic ocean. Self-sufficiency within Canada is now seen to be of national interest so two major pipeline projects are currently under discussion. The first is the reversal of Enbridge Line 9 from Sarnia through Ontario to Montreal. The second is called the Canada East pipeline and involves the conversion to oil of a natural gas pipeline that would eventually connect Alberta to the Maritime Provinces. These combined projects could add up to 1,150 kbbl/d capacity by 2018.

The Trans Mountain and Gateway Pipelines. The recent rapid rise in US oil production means that oil sands companies in Alberta no longer have guaranteed access to US markets. This has increased the interest and urgency in gaining pipeline access to tidewaters. Kinder Morgan wants to twin their existing Trans Mountain pipeline that brings oil to Vancouver and Enbridge has applied to establish a new Gateway pipeline to Kitimat, BC. These pipelines could open up Pacific markets to Alberta oil, a market opportunity that has been forecast to increase to more than 15.5 Mbbl/d by 2040 (EIA).

The absence of this pipeline capacity has meant that more crude oil is moving to markets by train, which is not only significantly more expensive, but has a much higher environmental and health risk than do pipelines. The lack of takeaway capacity has also created a ‘Bitumen bubble’, where Canadian oil sells at a significant discount to other oil in the U.S. and global marketplace.

While North America is redrawing its oil production map, applications for new pipeline approvals have triggered strong opposition from environmental groups and the broader population. This is especially true in Canada, where most of the proposed pipelines originate. Four key issues include:

Climate change. Unconventional sources of oil have higher CO2 equivalent emissions associated with their recovery than conventional sources. As a result, the ‘well to wheels’ GHG emissions of unconventional oil is on average ~17% more than conventional oil. A more fundamental issue is the question as to whether the unconventional energy resources should be developed at all as this perpetuates our reliance on fossil fuels and may trigger ‘run-away’ climate change.

Water. Shale oil and oil sands recovery operations are also associated with large volumes of water that have been linked to the contamination of surface and ground water resources.

Spills. Spills of oil from pipelines, trains, ships and offshore oil production systems are frequently in the news and have contributed to the public’s concern about developing and transporting oil. While most oil will float on water making it possible to clean up, bitumen’s high density means that it could sink in water making remediation more challenging.

Aboriginal relations. The proposed pipelines are often designed to cross aboriginal lands where there is significant resistance.

To address these challenges, a concerted research effort is underway to develop and deploy new recovery technologies with a lower environmental footprint. For example, 12 of the largest oil sands companies in Alberta have recently joined forces to establish an ‘open innovation’ corporation that is focused on “accelerating the pace of improvement in environmental performance.” While per barrel improvements have been achieved and should continue, the planned increase in overall production levels means that the total environmental footprint is likely to increase. The only way this will not happen is if the economic benefits of production are coupled to investments that result in major structural changes in North American energy systems.

A paradox and an opportunity

While differences exist among stakeholders regarding which of the issues are most important, the global nature of climate change issue seems to be one that has attracted the greatest attention across North America and around the world. Concerns about the climate change impact associated with developing and exporting unconventional oil has adversely affected the public license which is, in effect, ‘closing the tap’ on export of these products to global markets (Fig. 2).

This has created both a paradox and an opportunity, especially for Canadian energy, environmental and economic policy.

The paradox is that the barriers to market access have depressed the bitumen price relative to the North America oil price and the North America price relative to the global price. This not only hurts the Canadian economy, but also creates a strong disincentive to reduce domestic fossil energy demand and invest in climate change solutions. This is exactly the opposite of what environmentally conscious Canadians want to see happen, and why many are opposed to these energy projects.

History has shown that the political will to implement a long-term vision requires a strong economy.

The opportunity is for governments and industry to gain the public license to develop and export fossil energy resources by locking it to real, tangible action on climate change. What if pipeline access to oil markets were to be linked to a meaningful per barrel investment into programs that would transform Canada’s domestic energy systems toward sustainability? Such an investment would be a fraction of the lost income associated with the current problems in market access, and would generate billions of dollars a year to create jobs, improve energy efficiency and make NA energy system more sustainable.

It is often said that the ‘long term vision’ for our elected officials rarely extends beyond the four-year election cycle. The new NA oil era of ‘insecurity in market access’ has created a situation where there is a potential link between the short term benefits that politicians love, and the long term needs for a sustainable energy system that respects both the environment and the economy.

Notes

All EIA numbers mentioned in this paper come from EIA Annual Energy Outlook 2013 or Annual Energy Outlook 2014 Early Release Overview. A large number of references mentioned in this paper can be found in From Insecurity in Oil Supply to Insecurity in Market Access: Is North America Oil Supply and Demand Entering a New Era?