There’s no shortcut when it comes to aircraft engine programs. Delusion and self-deceit never work. Any attempt to achieve success without diligent work is going to fail ultimately……It has been proven by the fact that, aircraft engine research and development should be built on 80% past experience and technology accumulation, and 20% innovation. Without solid technological support, innovation has no soil to plant in. One will pay for any unscientific conduct if rushing for innovation, and will end up with nothing desired.

Read this article in Chinese

GE:A Centenarian, An Aircraft Engine Industry “Hegemon”

Today, there are only Four commercial aircraft engine OEMs in the world, or the “Big Four”: General Electric (GE) and Pratt & Whitney (P&W) from U.S., Rolls Royce (RR) from UK, and Snecma (Safran group) from France. They are providing engine products and services to the trunkliner manufacturers, Boeing and Airbus, as well as to two regional jet manufacturers,Bombardier and Embraer. Furthermore, their customer services cover hundreds of airlines over the world. The Big Four and their associated JVs are engaged in a “frienemy” situation of fierce competition for market share on one hand, while forming alliances on the other. Through win-win cooperative strategies, the Big Four can lower risks in technology development and capital investment, while setting a higher threshold for latecomers, which effectively bars disruptive new players. They have in fact created an aircraft engine market oligarchy.

According to the report “Commercial Engines 2014”, in 2013, there were 2,598 engines delivered and 21,636 ordered by Airbus and Boeing. See chart below:

2013 Engine Manufacturers Ranking (Data from ”Commercial Engine 2014”)

| Company | Delivery/units | Market persentage | Order/units | Order persentage |

| CFM International

(JV of GE and Snecma) |

1,386 | 53% | 10,280* | 48% |

| GE | 436 | 17% | 2,004 | 9% |

| IAE (JV of PW, RR et al) | 442 | 17% | 1,382 | 6% |

| Rolls Royce | 234 | 9% | 2,672 | 12% |

| Engine Alliance

(JV of GE and P&W) |

64 | 2% | 308 | 1% |

| Pratt & Whitney | 36 | 1% | 1716** | 8% |

| N/A | 3274 | 15% | ||

| Total | 2,598 | 21,636 | ||

| *Including CFM56 and LEAP engines

**Mainly from PW1000G Geared Turbofan (GTF) engines |

||||

CFM International – a joint venture owned equally by GE and Snecma (Safran group) – is listed at the top of the chart. It benefits greatly from sale volume of its popular CFM56 and LEAP family engines: both delivery and order rank at the top among peers. GE comes in at second place thanks to its advantage in wide body and regional jet engines. Thus, adding them together, GE unambiguously earns the title of the ruler,or the“Hegemon”in commercial aircraft engine business in the world.

GE Aviation is one of the eleven (11) subsidiaries of General Electric. It plays a leading role in producing engines and parts for civil, military, business and general aircraft. It is also one of the top suppliers in avionics, power and mechanical systems for aircraft integration. GE Aviation recorded $22 billion in sales in 2013, accounting for 15% of GE’s total, 42% of its sales volume was generated in the U.S., while 58% came from the international market.

In its century-long history, with countless bumps and setbacks, GE Aviation learns from experiences, continuously sets new standard in high-tech research, development and application, and has become an icon of engine industry around the world.

Emphasis on Research and High-Tech Development

GE Aviation, on average, spends billions of dollars, or roughly 10%-15% of its revenue each year on engine technology R&D, which is around 3 to 5 times of other American industries in average. The expenses are allocated as follows:

Usually, GE Aviation spends 10-20 years to research and develop advanced technologies, amass experience and avert risks in order to come up with well-functioning engine designs that make good economic sense. Meanwhile, GE Aviation also works hard on improving quality and efficiency of engine parts manufacturing, remarkably extending their lifespan and reliability, reducing the number of parts used in each engine, and cutting research and manufacturing costs, which bring real benefits to airlines and customers. On top of that, GE continues to enjoy substantial U.S. government support to develop and apply high technology to design new engine products and improve performance of existing products, which has helped GE survive and thrive amid fierce market competition.

GE has achieved many research breakthroughs and made numerous technological innovations through long-term and large-scale investment. GE manufactured the first jet plane engine in the United States, the world’s first turbine-propeller engine, the world’s first turbojet engine for fighter jet flying at twice the speed of sound, the world’s first high bypass ratio turbofan engine, blisk structure, 3-D weaving RTM composite material fan propeller, low emission TAPS combustor , and other state-of-art technologies. The most eye-catching contribution by GE is the application of high bypass ratio turbofan engine technologies to aircraft powerplant, which enables super large military transport aircraft, such as the C-5A, to showcase the huge power of this new high technology. The debut of the high bypass ratio turbofan testified the power of this new technology to the world: greatly increased thrust, energy savings, noise and emission reductions, and improved reliability. It enabled green and economical power for advanced commercial flights and ushered the commercial aircraft engine industry into a new era. GE is well known for its high-tech innovation, outstanding products and caring services in the aviation industry. It has been proven by facts that generous investment in R&D is a prerequisite for the future success of its products.

Sharing Risks and Benefits with Clients and Partners

A profitable project needs at least 20-50 years of nurturing in the aircraft engine business. The management of GE maintains close personal relationships with leaders of aircraft manufacturers and airlines to build long-term trust. Usually, before an airline bets on any new engine products, it has to have thorough recognition and trust on supplier. Suppliers are accountable for any unexpected glitches in a product during its full lifespan and should provide timely technical support or even share financial losses. No matter customers have any problem, GE would dispatch on-site personnel and work closely with customers to resolve issues effectively to utmost satisfaction of clients.

GE has developed a global strategy of seeking “Revenue and Risk Sharing Partner” (RRSP) who will undertake technical and financial responsibilities associated with R&D of advanced aircraft engines. The CFMI, a 50/50 JV created between Snecma and GE, rolled out the CFM56 engine family in the 1970s, and set an outstanding example for international cooperation in aviation industry. The CFM56 engine generated over 10 billion dollars in revenue for both companies. On top of that, Snecma grew from a domestic military aircraft engine manufacturer into one of the international top players, or the Big Four, in the field of commercial aircraft engine business. GE and its partners co-invested in engine project management, engineering applications, R&D, manufacturing, capital allocation and marketing and gave full play to their own strengths. GE also worked out best cooperative practices with partners by leveraging their own advantages. On the other hand, GE benefited massively from adopting the strategy of close cooperative partnerships, and at the same time this also isolated market competitors. GE figured out techniques or “recipe” when dealing with different countries and people thanks to frequent global partnerships, and it laid solid foundations for win-win cooperation in civil aircraft engine programs between GE and international partners. Certainly, GE’s conduct and model in seeking win-win cooperation with partners and suppliers is worthwhile of follow-up by other engine manufacturers.

Over the past few decades, the landscape of engine production, including military and civil aircraft engines, as well as marine propulsion and industrial gas turbines has experienced radical changes. GE’s portfolio was once 80% military engines, 20% civil engines, and almost nothing involving in marine and industrial gas turbines business. Nowadays, it has shifted to roughly 20% military engines, 60% civil engines and 20% marine and industrial gas turbines. The development of the engine industry no longer hinges upon demand for military aircraft. It has become mainstream for aircraft engine manufacturers to balance between the development of military engines, civil engines, marine and industrial gas turbines on the basis of close cooperation with military and commercial customers.

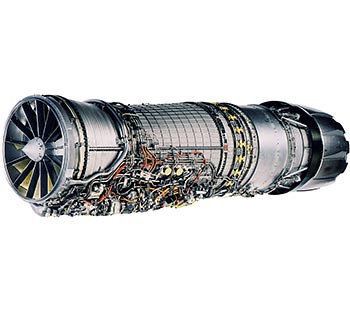

GE commercial aircraft engines

LEAP – jointly developed with Safran for Boeing 737MAX, Airbus A320neo, COMAC C919, expected to put into operation in 2016

It is well known that, aircraft engine industry behaves features of huge investment, high business risks, big technological challenges, long R&D cycles and fierce competition. The history of aircraft engine business has shown that, in order to develop an engine product which meet market demands with strong competitiveness and customer satisfaction, a company must have substantial capital investment, thousands of talented professionals in all related fields, well organized long-term strategy and planning, as well as consistent tireless effort for decades.

What can be learned from 70 years history in the development of advanced gasturbine engine ? First, an enterprise, or even a nation, should be very cautious to step into this aircraft engine business without ample preparation. The development of aircraft engines is both a capital and technology intensive. Huge capital investment and long term commitment is a must but not sufficient. The successful development of an aircraft engine will rely on many aspects like design, manufacturing, processing techniques, materials and test verification and certification. All these fields require special expertise and technology accumulation over long period of time. As an old Chinese saying goes, “10 minutes of on-scene performance requires 10 years of backstage practice.” The philosophy also adequately applies to aircraft engine development programs. A solid technological base is what makes a successful product finally working its way into the market, and holding its advantages.

Take an exemple, an advanced commercial turbofan engine of 15 tons thrust requires around $1.5-3 billion in R&D costs, assuming readiness of key technologies, high level management personnel, industrial experts, design, testing and production capabilities. Any mistake in judgement or decision-making will lead to severe consequence. All-round product planning is critical to market positioning of an engine. Product strategy and planning shall include range of propulsion, fuel efficiency, product lifespan, reliability and maintenance costs to specify what makes the product stand out from its competitors. Airlines will be able to see tangible benefits and advantages in the engine. Aside from the aforementioned quality assurance, cost-saving becomes extremely important in manufacturing. In fact, cost-saving starts from structural design and requires big investment in advanced manufacture processing and technological R&D. Engine manufacturers will have to build a viable roadmap from the product planning stage that can be implemented in an orderly way.

Aircraft engine manufacturers are also obligated to produce high quality products with performance meeting industrial standard. The company will risk losing a large amount of orders or even paying expensive penalties to airlines if it fails to turn in an order on time, or the products are of poor quality. Such misconduct is also detrimental to the reputation of the company.

With the rise of fuel prices, airlines spend today 35%-40% of total operating cost on fuel, compared to only around 15% in the past. Aside from that, FAA, EASA, ICAO and other international civil aviation regulation authorities have been ratcheting up requirements on emission and noise reduction of aircraft. Fuel efficiency, contamination and noise reduction have become key indicators in the modern aircraft engine industry,and bring new challenges to energy saving and emission reduction efforts.

Airlines are scrambling to have aircraft and engines that consume less fuel and save costs. Engine manufacturers are thus obligated to work together with aircraft manufactures to develop engines and airplanes that meet market demands. Engine developers need to comprehend the technical demand, aircraft structure, freight and passenger transport planning, maintenance plan and financial conditions of its customers. In general, airplanes and engines are all expensive products that need to be in service for decades. Airlines always hope to acquire affordable and reliable engines with durable components that are easy to maintain. They will take into account the cost to own an engine over its full lifespan, including its maintenance and spare parts. All competitors will normally provide products and services that meet the above requirements to win favor from clients. Airlines take assessment of product performance, brand loyalty, technological support and after-sale service as key factors in choosing engine suppliers.

Manufacturers of both commercial and military aircraft engines endeavor to lower costs. However, pricing strategies and politics for each are vastly different. The department in charge of procuring military equipment may come up with a cost price on the basis of the procurement target and budget. Engine manufacturers confirm the price according to their own development strategy, project competitors and price viability, while the price of commercial engines is dependent on market competition. The sale price of commercial engines tends to be much lower than its cost. Engine makers need to put in place a cost reduction plan from the beginning of a project and break even, or even make some profit through bulk sales and after-sale services. For military engines, buyers explain all their requirements to the manufacturers, which will follow their instructions step by step and produce what is asked for; whereas commercial engine makers take full responsibility for the design and technical issues of an engine. The government pays for military aircraft engine R&D; while costs for commercial aircraft engines are covered by manufacturers themselves to develop their own engine that meets market and customers’ demands. It is almost impossible to meet requirements from both military and civil clients with identical strategies, as operational features are completely different in these two markets. These two types of clients hold exclusive needs in aircraft engines. Military clients are looking for the most advanced, least detectable, and lightest but most propulsive engines; while airlines prefer their engines to be reliable, safe, having low emissions and noise pollution, and be fully functional throughout their lifespan.

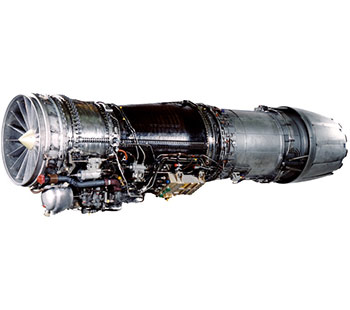

GE military aircraft engines

F110 – Powering The third-generation jet fighter like F-16C/D Fighting Falcon, F-14 Tomcat, F-15 Eagle, etc. entry into service in 1985

F414 for the F / A-18 “Super Hornet” carrier-based attack aircraft, India’s “brilliant” MK-2 fighter and other “third generation machine”, which entered service in 1998.

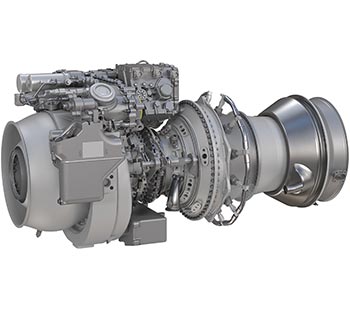

GE3000 for the next generation, “Black Hawk”, “Apache” military helicopters, expected to put into service in 2018;

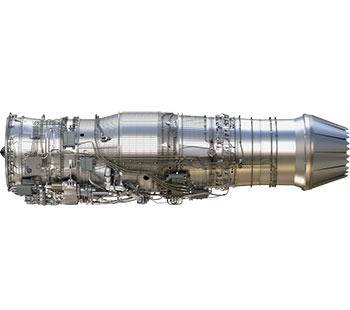

ADVENT variable cycle engine – used in the US fifth generation fighter, is expected to put into service after 2020

Digestion, Consolidation and Transformation: The Way to Develop China’s Aircraft Engine Industry

China has built a full scale functioning aircraft engine industry, consists of a number of research institutes, manufacturers, as well as hundreds of specialized part and system suppliers. Nevertheless, for decades, its engine products have only been sold in domestic market, especially for military applications. It has been stymied and backward due to the lack of practical long-term technology development strategy, sufficient budget and competitiveness in the international market. It is widely believed that China’s aircraft engine industry is significantly lagging behind its European and American peer companies in terms of talent, technology, infrastructure, specialties, productivity and corporate management.

If we look through the past seven decades of development in the global aviation engine industry, it is obvious that simply “cloning” or “copying” a successful model never works. We should probably steer out a way of three steps, or “Digestion, Consolidation, Transformation”. We should learn from success of foreign companies by grasping the essence of their management philosophy and comprehending what and how they are conducting business, and digest them into our business practice. On the basis of that, domestic players should consolidate and digest what they have learned and acquired through studying experiences and output of GE or other members of the Big Four. Afterwards, it’s on Chinese companies to optimize and transform learned conduct and experiences into unique procedures that match Chinese enterprises. In this aspect, Snecma has successfully employed the “Digestion, Consolidation, Transformation” strategy in 1970s through its collaborative project of the CFM56 engine with GE, and smartly absorbed GE’s conduct and management. Today, Snecma has become an acknowledged commercial aircraft engine OEM, one of the Big Four.

There’s no shortcut when it comes to aircraft engine programs. Delusion and self-deceit never work. Any attempt to achieve success without diligent work is going to fail ultimately. Companies which want to take shortcuts and look for easy success by simply borrowing overseas experience will end up being empty-handed with great losses in capital and time. It has been proven by the fact that, aircraft engine research and development should be built on 80% past experience and technology accumulation, and 20% innovation. Without solid technological support, innovation has no soil to plant in. One will pay for any unscientific conduct if rushing for innovation, and will end up with nothing desired.

As of today, China’s economy scale and strength is enable the nation to invest in some mega projects, which has been exemplified by hundred billion dollars investment in high speed railways. At the end, it has generated tremendous social benefit and economic return. Aircraft engine is not only a strategic industry for economy, technological development and national defense, it also represents the strength of a country. Developing a variety of engine types can not only empower military and civil airplanes, vessels, tanks, power stations, natural gas and oil pumping, but also greatly leverage science and technology to a higher level for related industries, such as energy, transportation, machinery, metallurgy, materials et al.

For a long time, aircraft engines that are high-tech and industry valued have been monopolized and highly protected by developed aviation industry countries like U.S., Britain, France and Russia. As to the date, China’s aircraft engine industry is seriously lagging behind its western peers, and has become the “bottleneck” that has constrained the development of the entire nation’s aviation industry. Although Chinese airlines can acquire advanced powerful turbofan engines by purchasing commercial aircraft from the West, even China’s commercial airplanes like ARJ21, C919, MA600 and MA700 can install West engines directly, engines for military transport aircraft, fighter jets, navy vessels and tanks have only to be equipped with domestic engines due to military technology embargoes imposed by western countries. On the other hand, according to our specific study on Chinese future economic and aviation market, China will keep strong growth momentum, GDP in the coming two decades (2015-2034) is likely to rise at 6.2% annually, while RPK and RTK climbs by 8.0% and 8.7% respectively, making China the fastest growing country in the world. 13,930 units of commercial turbofan engines will be required nationwide, creating a market value of $145.7 billion. It would be a great loss for nation’s economy and also a pity for nation’s aviation industry to hand this huge piece of “cake” to western competitors.

Hence, as for government, more attentions and engagement are needed in respect of the research and development work of aircraft engines. Government should also consider the preferable policies and budget arrangement adopted in the West to better support the development of aircraft engines. Meanwhile, more advanced and modern management approaches should be adopted, and limited resources should be concentrated into a few practical key programs, so as to use effectively every cent of tax payer’s money. It should avoid to pursue unrealistic goal hastily, expecting a quick hefty return, It would take at least 20 years of hard working with solid step by step approach to cure completely China aviation industry’s “heart disease”.

We believe that China’s aircraft engine industry can flourish only it is able to roll out its own product, enter international market and thus become the fifth commercial aircraft engine OEM in the world after the Big Four. In this case, China will transformed from a big aviation market into a technologically powerful nation in world’s aviation industry field.

(This article is selected and edited from 《Centennial Story of GE Aircraft Engines》by Ni Jingang / Aviation Industry Press, April 2015)