It was indeed a pleasant coincidence: Just the day before I visited Flex’s plant in Zhuhai on an invitation, I had read the new OECD report on The Future of Productivity:

“Productivity growth of the globally most productive firms remained robust in the 21st century, despite the slowdown in aggregate productivity, but the gap between those high productivity firms and the rest has been increasing over time. Labour productivity at the global technological frontier increased at an average annual rate of 3.5% in the manufacturing sector over 2000s, compared to just 0.5% for non-frontier firms, while the gap is even more pronounced in the services sector

……

“The relative strength of such global frontier firms likely reflects their capacity to ‘innovate’, optimally combine technological, organisational and human capital in production processes throughout global value chains (GVCs) and harness the power of digitalisation to rapidly diffuse and replicate leading-edge ideas.

Standing in front of the amazingly-efficient electronics production lines in the town-like Flex Industrial Park with approximately 50,000 employees, these toneless statements (made by OECD) started to echo in my mind.

At least in the various press articles, Flex’s strategic transformation in recent years has often been attributed to survival efforts at a time of increasing cost pressure and labor supply shortage. However with the OECD report as reference, the visit has given me a new understanding of Flex’s approach to survival and beyond.

Read this article in Chinese

The core of the plant: workshop or laboratory?

Most of my day at Flex Zhuhai was spent on visiting various R&D labs and technology centers scattered in the plant. These labs and research centers were ordinary-looking from the outside, without the flashy metallic qualities of a typical high-tech outfit. It was only the highly-stringent security checks and the closely drawn curtains that evoke people’s imagination on what highly-confidential products were being developed in those quiet rooms.

The BU-X is one of seven product innovation centers of Flex worldwide. Occupying only one floor in a five-storey building, BU-X is actually an independent “micro plant” that is responsible for developing and testing new product concepts for customers coming from a wide range of sectors including medical, wearable devices and Internet of Things (IoT), which must be kept absolutely confidential as the technologies are ahead of the market.

In contrast to traditional new product industrialization processes, BU-X must provide complete engineering, production, supply chain design, prototype making, function analysis and testing, manufacturing and delivery solutions.

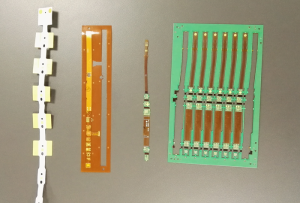

The cutting-edge technologies used by BU-X, which has five PhD holders, to develop the concept products come from various technology R&D departments. For example, at the Multek Interconnect Technology Center (ITC), researchers are working hard to develop new printed circuit boards (PCB), including flexible PCBs mostly for wearable devices. In the area of any-layer interconnected circuit board technology that is mainly applied in smart phone products, Flex is now working on the 18th layer, which is an industry first globally.

“In the past, you just embed the circuit board into a product and then not worry about it,” explained Dr. Joan K. Vrtis, Multek’s CTO, to visitors, “As it won’t be frequently moved, stretched or bent. However, in wearable devices, these are all prerequisites. Not only that, because they are worn by people, you must also study people’s body, skin, usage scenarios, experience and all human-related aspects. These have brought unprecedented challenges.”

More labs and R&D investment, but that’s not all. “In terms of the plants, early intervention in the product life cycle means re-layout of the workshops,” says David Johnson, VP, Product Industrialization, Flex Consumer Technology Group, “The physically separated machinery, molding and packaging workshops of traditional plants may need to be placed together. For example, to constantly study and modify the wearable products, surface mount technology (SMT) and machinery zones need to be merged in a clean environment, as their assembly process is very complicated.”

At Flex, the main responsibility of the Advanced Engineering Group (AEG) is to offer technology development services and automation solutions. They also help the production department and customers optimize product design based on the conditions of the production lines or provide customized process in accordance with customer requirements before production, for instance, applying the most advanced Package on Package (PoP) technology —components densely integrated in a very small space —in the assembly lines for wearable devices.

PCBs for wearables have very special requirements in terms of the materials, features and functions. / Photo by Gina

In July this year, the Company’s original name Flextronics was changed to Flex. Michael Mendenhall, Flex’s CMO, says the reason was for the marketplace to know that Flex is no longer a mere electronics manufacturing services provider. From now on, Flex will strive to be a Sketch to Scale total supply chain solutions provider of IoT products, which is more clearly defined with vigor than “end-to-end supply chain solutions provider”.

Apart from its powerful manufacturing strength and global supply chain, an interesting topic would be on how Flex will configure its front-end innovation resources in such a transformation context.

New grassland: in alliance with startups

“How big should the order be for Flex to consider offering customers customized production lines and processes?”

To this question, an AEG spokesperson answered: “If the product or technology is in line with the direction that we intend to explore, we will cooperate with the customer on the development.”

When you open up Flex’s official website now, you probably will not see any images of plants, but only a message of invitation displayed in ultra large fonts: “Be it startups working hard on prototype design, or industry leaders looking to quickly occupy new markets, Flex can help all.”

IoT or the Intelligence of Things, is undoubtedly the most important driver for Flex’s strategic transformation. It’s a completely new and promising pasture with no fences. It is estimated that by 2020, there will be 50 billion smart devices connected with each other, constituting a market of enormous potential, with more and more enterprises entering the field with disruptive products, as the popularity of components such as sensors have significantly lowered the entry barrier. But on the other hand, many of the new players lack the necessary engineering and technology resources.

“We discovered that especially in the wearable device arena, many small-sized enterprises only have about 10 people and are very short of expertise,” says David Johnson, “they often are a group of software engineers with a good idea. However, we can offer manufacturing knowledge to make their products better and industrialization process faster. We should get involve earlier — although to a certain degree, this requires the re-configuration of our own supply chain to be in line with the characteristics of the startups’ products.”

In Multek’s ITC and the BU-X, we kept hearing the term “startups”. Startup teams are invited to these labs and technology centers to work and experiment with Flex’s engineers and experts, and separate rooms will be provided for those young IoT entrepreneurs.

As of now, Flex has 26 startup partners around the world. It is also working with universities and research institutions organizing innovation competitions to identify innovative products and teams across the world. Winning teams will have the opportunity to turn their innovative ideas into reality at Flex’s global innovation centers.

Human and machine: reallocation of resources?

Talking about their second Universal Box Build (UBB) production line that is scheduled to be put into operation within the year, Tony Wu, vice president of operations and general manager of Flex Zhuhai, became animated.

“Plant automation is the trend and an inherent requirement of Industry 4.0,” says Tony, “for us, adoption of automated production lines not only mitigate labor shortage and rising cost, but also improve yield. And more importantly, the product can be traced back to the production of each component. We now have one UBB mainly for smart phones. Compared with the ordinary production lines, the UBB line requires 100 less workers. But for those employees that remain on the production line, they will be equipped with higher and more professional skills.”

In July 2014, Flex installed its first fully automated high-tech UBB production line that connects into IoT via intelligent sensors, actuators and cameras, in its customer innovation center in Silicon Valley, to assemble large format products such as servers, switches and storage systems. What makes this production line different from other automated equipment is its capability to provide real-time video and data streams to enable engineers and customers to remotely analyze data, thus enhancing productivity and predictability.

In regard to the wearable device that has become increasingly important in Flex’s product strategy, its characteristics of small volume, medium-low scale and high-end has increased labor cost, while putting the development of automated production lines under challenge. “The industry will soon experience a hockey stick growth,” says Joan K. Vrtis, “So we need to make the whole production system more flexible as soon as possible to be ready for any new product orders and automate as many manufacturing processes as possible.”

The efficiency of robots used for the manufacturing of small electronic devices has always been questioned. Compared with the dexterous hands of a human being, automated production lines may find it difficult to deal with the minuscule assembly space and micro components. And while it’s common to see a mechanical arm performing tests on a server’s circuit board in Flex’s Regional Technology Center, when one picks up an automatic 3cm wearable insulin syringe and says it came from a fully automated production line, it seems we must modify our expectations for the speed of automation application.

Positive externalities of Flex’s transformation: difussion of innovation

The most thought-provoking aspect of The Future of Productivity report by OECD is not the fact of sluggish growth of productivity, but the reasons behind it: It is not that innovation has slowed down, but because the mechanism of innovation spreading from “global frontier firms” to the overall industry did not work out as it should have. In other words, the improvements of productivity and innovation have been restricted to large enterprises, new knowledge and technologies have not infiltrated the industry at large.

The IoT sector, where Flex sees huge opportunities, seems set to boom in the short term, with players of various sizes offering a wide assortment of products with different applications and functions. But after a while, will the same thing happen as with the information industry? – i.e, the whole market is dominated by just a few major software and hardware companies? After all, the major players who had already sharpened their weapons in the last wave of digitization may only need to decide which they should eat , the grass or the sheep on the new grassland?

But the move into the new fields by companies like Flex may create some positive effect, i.e., enabling innovation proliferation, experimenting with leading-edge technologies, helping startups compete, engaging with academic institutions, more effectively configure labor and capital, rebuilding the value chain to enable synergies between R&D and manufacturing, etc.

“Large enterprises outsourcing their manufacturing has long been the premise for our continued technology innovation,” says David Johnson, “But we are interested in helping startups to acquire financing and other resources. If we do not do this, the industry may just be dominated by powerful players.”

automation | industry 4.0 | innovation | IoT | manufacturing | start-up | wearables