This study describes briefly the strategic status and development feature of aircraft engines, as well as the successful aircraft engine industry in Western countries (US, UK, France) being an integrated, market-bonded whole led by major manufacturers or OEMs, and supported by government, clients and suppliers, whose roles and responsibilities are clearly defined. It demonstrates that, the fundamental solution to revitalizing China’s aircraft engine industry lies in a market-oriented national mechanism. To this end, following suggestions are proposed: 1) marketing reform of major aircraft engine manufacturers or OEMs, 2) building an inclusive supplier system, 3) establishing national aircraft engine research institute, and 4) attracting experts from abroad and helping tap their full potential.

Read this article in Chinese

1. Strategic Importance and Feature of Aircraft Engines’ Development

Engines or propulsion systems, being “heart” of aircraft, are complex thermo-mechanical machines that operate in extreme environments (very high temperature, pressure, and rotating speed) and are demanded to maintain a supreme high level of reliability and safety guarantee. These high-tech products have typically both civil and military applications. A country’s capability in development of advanced aircraft engine is an important indicator of national industrial, military, technology, and economic level, and even a symbol of the country’s integrated strength. The aircraft engine industry is knowledge-, skill-, and capital-intensive, and plays a key role in a nation’s economic and security fields. So far, only a very small handful of countries in the world, such as US, Russia, UK, and France, are able to develop advanced aircraft engines independently. The aircraft engine industry is recognized as a strategic industry in all of these countries, and receives significant policy and financial support from their governments, who prioritize the industry’s development, dominate the industry, maintain tight monopolies over the sector and strictly forbid the export of any core technology.

Propulsion systems, including military and civil aircraft engines and gas turbines, efficiently provide reliable mechanical power to fixed-wing aircrafts, helicopters, missiles, ships, tanks, specialized vehicles, power generation stations, and pump stations. The more advanced the propulsion systems of a country, the more advanced its aerial equipments and weapons. Advanced aircraft engines are crucial to victory in modern warfare. In addition, their technology development can take the high-end manufacturing sector of an entire country to a brand-new level. Aircraft engine industry is recognized as the “engine” and “locomotive” of a country’s industrial development, as growth of the sector and development of new technologies can bring remarkable growth for the entire military and civil supply chain, in addition to having tremendous positive impact on the country’s national defense and security.

However, aircraft engines are technically challenging to develop. Development is time-consuming and requires a tremendous amount of investment, while returns cannot be guaranteed.

Modern aircraft engines are expected to be small in size, light in weight, and to have high output power and very long life cycle. Core engine (which includes the high-pressure compressor, burner, and high-pressure turbine) may reach temperatures of over 1,700 °C in operation—well above the melting point of carbon steel. HPT blades are subject to a number of loadings, including centrifugal force and high frequency vibration fatigue stress that is the result of high rotational speeds, as well as the bending stress, distortion stress, and creep stress brought on by the rapid flow of high-temperature fuel gas and specifically designed blade form. It is incredibly difficult to model the thermo-mechanical damage and failure of such cases. Standards for performance for these engines operating in such harsh environments tend to be high, which is why the aircraft engine industry is technically challenging on a level incomparable to that of traditional industries.

Aircraft engine development as well as its Certification is a highly complex project requiring a systematic approach for every standard to be met. A developed industry, a skilled technical team, a complete high-level management organization, and ample experience and knowledge need to be brought together. It takes approximately ten to fifteen years for an aircraft engine manufacturer from a Western country with an advanced aeronautics sector (such as GE, Rolls-Royce, Pratt & Whitney, or SAFRAN) to develop and to certify a civil aircraft engine with a thrust in the medium range (10-15 tons) under ideal circumstances (having all of the core technology, and testing equipment as well as experienced engineering and management teams).

Figures from the last thirty years show that, in US and European countries with a strong and developed aeronautical industry, the public and private sectors spend on average a total of $1-3 billion on developing new aircraft engine technologies. The development cost for an advanced medium-thrust aircraft engine stands at $1.5-3.0 billion.

There had been many past instances where an aircraft engine development project failure led to enormous losses.

1) In 1970, Rolls-Royce utilized a new, yet-unproven composite material, Hyfil, for the fan blades of its RB211 three-spool engine. Hyfil turned out to be a failure and resulted in major setbacks for the engine development program. Rolls-Royce subsequently missed the window of opportunity for the marketing of their engine, sustained staggering losses, and was placed into receivership in February 1971.

2) In 1986, the Indian government began investing in the Kaveri turbofan (afterburner thrust: 10 tons), intended to power their HAL Tejas fighter. The project costed over $1 billion but was eventually announced a failure after 20 years of development, as many of the engine performance guarantees could not be reached.

3) In 1999, Pratt & Whitney revealed that the PW6000, a turbofan jet engine designed for the Airbus A318, then under development, was unable to meet several performance targets. As a result, PW had to redesign and develop a number of core components, such as the high-pressure compressor and low-pressure turbine. Certification of the PW6000 was delayed for 3 years, and many of the original customers switched to the rivaling CFM International (a joint venture between GE and SAFRAN), resulting in significant losses for Pratt & Whitney.

Many countries and regions around the world, such as Germany, Japan, Brazil, and Taiwan had attempted to develop their own aircraft engine industry, becoming member of the “Aircraft Engine Club”, but all without success.

These facts show that it is highly unwise for a company or even a country to enter the aircraft engine sector without the right circumstances, at the risk of losing most if not all of its initial investment but having nothing to gain.

2. Aircraft Engine Research and Development Mechanisms in Western Countries

2.1 The US

Some of the research institutions directly invested in and run by the US government including the NASA Glenn Research Center, Air Force Research Laboratory (AFRL), and Arnold Engineering Development Complex (AEDC). The US government has invested heavily in aircraft engine pre-research programs, joining forces with entities in the industry. The purpose of pre-research is to ensure that future government spending in the field of aircraft engine manufacturing goes into the projects that are most likely to yield positive results. In the last 50 years, the US has launched over 20 major research and development projects covering every field of aircraft engine specialties, spending $1-2 billion per year on technology research and development. The projects have been largely successful and produced number of advanced aircraft engine technologies. Of particular note is the Integrated High Performance Turbine Engine Technology (IHPTET) program, a highly fruitful, $5-billion integrated Air Force, Army, Navy, DARPA, and NASA technology program that lasted from 1988 to 2015. The US government then launched the Versatile Affordable Advanced Turbine Engines (VAATE) program, investing in as heavily as in IHPTET. The success of these programs cemented the US’s position as the world leader of aircraft engine technology.

Figures from the last 50 years show that around 100 to 200 thousand people are employed by the aircraft engine sector in the US, making up about 20-25% of the total aeronautics workforce. Of all the government funding that goes into new engine technology, 75% is provided by the Department of Defense (for the development of military aircraft engine and relevant technologies), 15% by NASA (for fundamental engine technology research and development), 5% and 5% by the Department of Transportation and Department of Energy respectively (for the development of energy-saving and green technology). 15% of all R&D funds go into fundamental research, 25% to pre-research, and 60% to product development (which also includes product application, maintenance, and update).

It is apparent that the success of the US aircraft engine industry is inseparable from the policy and financial support from the US government, a competitive market mechanism established after decades of effort, the huge domestic and foreign market demand for military and civil engines, and the pioneering spirit of US companies domestically and worldwide.

2.2 Britain

In Britain, aircraft engine technology R&D is mainly undertaken by government research institutions, specialized research institutions, labs and R&D centers in universities and industrial R&D centers. Government research institutions (such as the Defense Science and Technology Laboratory, or DSTL), specialized research institutions, and university laboratories focus more of fundamental research, while industrial R&D centers focus more on developing prototypes and applications for new technology. In aircraft engine fundamental research, Britain often partners with EU countries, such as France or Germany, to launch research programs, such as HUDC, ACME, ASTEC, AMED, SILENCE(R), EEFAE, and the more- and all-electric engine program.

Britain on its own is no match for the US due to its relatively smaller economy and market size, which is why it has chosen to partner with the US and EU member states. Such a move would lower the amount of investment required of Britain, reduce the risks it would have to shoulder, and help the country better expand its market share. Although there had been numerous setbacks in the British aircraft engine sector in the past few decades, an appropriate strategy for engine development was eventually identified. Today Britain remains one of the most advanced countries in terms of aircraft engine industry.

Rolls-Royce, the leading aircraft engine manufacturer in Britain, employs over 40,000 people in more than 30 countries and regions around the world. It is one of the most important players in the global civil and military aircraft engine market and global marine propulsion and energy market. Rolls-Royce’s business includes engine fundamental technology research, product design, product development, engine manufacturing, maintenance, repair, and after-sales services. Rolls-Royce, with 30% of the market share, is currently the second-largest aircraft engine company in the world, after General Electric. Each year Rolls-Royce spends $1-1.5 billion (50% of which is government funding) in engine research and development, equivalent to 15% of their annual sales revenue.

Some of the key factors behind the success of Britain’s aircraft engine industry are:

1) The importance attached to the aircraft engine industry and strong support given by the government;

2) The establishment of a healthy development model that consists of national research agencies and technology administrative authorities, engine manufacturers, components, parts and systems suppliers, and technical support and consultancy organizations;

3) Companies with the best expertise and R&D experience driven to produce innovative, cutting-edge technology that helps them gain more market share;

Product and technology development partnerships with the US and European countries that reduce cost, investment and development risk, and help to further expand Britain’s market share in the world.

2.3 France

In the seven decades after the end of WWII, France has established and perfected its mechanism for aircraft engine technology research and product development. The Office National d’Etudes et Recherches Aérospatiales (ONERA) and the Directorate General of Armaments (DGA) together employ over 1,500 engineers specifically for the purpose of fundamental technology research and development. In addition, the Centre National de Recherche Scientifique (CNRS) and numerous university labs are actively engaged in basic engine research and development of new technologies.

SAFRAN is the leading French aircraft engine group, capable of developing a large range of engines, including turbofan, turbojet, turboshaft, turboprop, and propfan. SAFRAN engines are widely used in military, civilian, business and executive aircrafts, as well as helicopters, drones, and missiles. Along with GE, Rolls-Royce, and Pratt & Whitney, it is one of the four largest Western aircraft engine manufacturers. Figures released by SAFRAN in December 2016 show that the group had 66,500 employees and sales revenues of €15.8 billion in 2016, with profits reached €2.4 billion. In 2016, SAFRAN spent €1.7 billion on R&D, and acquired patents for 850 new inventions. The group’s aircraft engine business contributed to 60% of its total revenues. In 2016, the French government and SAFRAN together spent €2.4 billion on aircraft engine R&D (spending was evenly split between the two), 15% of engine sales revenues of the same year. The main products of SAFRAN (formerly known as SNECMA) are the CFM56 series and the newly developed LEAP engine, which are developed in partnership with GE Aviation. The CFM56 series is an enormous success story, with 30,000 units sold so far. Just at its first year of enter into service (EIS), 14,000 units of the LEAP engine were ordered, breaking a number of world records in the aircraft engine industry.

Some of the factors behind the success of the French aircraft engine industry include:

1) The importance attached to the aircraft engine industry by the French government, which has provided strong policy and financial support;

2) The establishment of a healthy development model that consists of national research agencies and technology administrative authorities, engine manufacturers, parts, components and systems suppliers, and technical support and consultancy organizations;

3) SAFRAN is always in focus on developing the most cutting-edge technology. Development decisions are made based on the company’s own capital and technology capabilities, as well as market demand. SAFRAN actively seeks to cooperate with engine manufacturers in Russia and elsewhere in Europe, in addition to devoting energy to ensure the great success of “star projects” such as CFM56 and LEAP.

2.4 Common Features of Aircraft Engine Industries in Western Countries

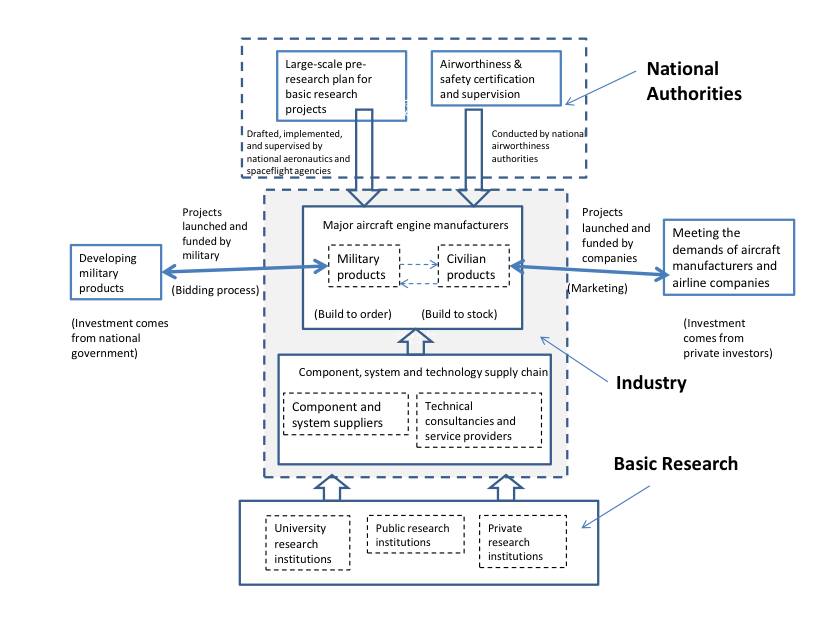

In US, Britain and France, aircraft engine development is initiated and piloted by the government and market needs, undertaken by industrial entities. The diagram below shows the basic development structure in these three countries.

Aircraft Engine Research and Development Mechanism in Western Countries

Aircraft Engine Research and Development Mechanism in Western Countries

At the heart of the structure are major aircraft engine manufacturers (OEMs). The entire engine industry is supported by a complete and mature supply chain (different level of suppliers). Usually, there would be one to two OEMs in one country. The OEMs are often corporation sole, and produce aircraft engines for both civilian and military market. Depending on market demand, they may also manufacture gas turbines for other applications. An aircraft engine manufacturer’s line of military products is usually produced according to military contracts won through a bidding process, with the R&D funding provided by military customers or the government. The development of products for civilian market is at the manufacturers’ own discretion. They are free to set up R&D projects and fund them however as they see fit. These products are then advertised and marketed to aircraft manufacturers, airlines, and other potential civilian/military customers. Most of these major aircraft engine manufacturers or OEMs are private enterprises, while others are state-owned, but all of them have a market-based business operation model.

The US aircraft engine market is dominated by GE and Pratt & Whitney—winners from many years of market competition. Rolls-Royce of Britain and SAFRAN of France have both been nationalized at various stages in their history (In the 1970s Rolls-Royce was placed into receivership and was subsequently taken over by Britain government; Snecma (SAFRAN’s predecessor) was a state company, wholly-owned by the French government in its early days. However, all these companies are publicly listed, and are not different from private enterprises in terms of internal management.

In the aircraft engine sector, a reliable, mature supply chain at different levels is crucial to the success of manufacturers’ engine program success. A good supply chain should have qualified raw material and parts suppliers, as well as professional technical consultancies and service providers. Technical consultancies can provide professional support to manufacturers and spare parts suppliers, and in addition act as a talent pool for the industry. In Western countries, the suppliers in the aircraft engine industry are always competing to meet the demands of major manufacturers or OEMs. From this competition a truly globally-oriented supply chain has arisen.

Basic research for aircraft engines is given high priority in Western countries as such research is crucial to the healthy development of the sector and the promotion of innovation. Basic research programs are usually centered on technologies with a technical readiness level (TRL) of 3 (i.e. at the stage of mechanism analysis and new technique, tool and software, or conceptual products development) and carried out by these countries’ sophisticated research institutions. When a technique becomes mature or TRL of 6 is reached, the new technology is transferred to major aircraft engine manufacturers, or OEMs, or suppliers for industrial application.

Basic aircraft engine research systems in Western countries consist of public and private research institutions and universities. Among them, national aerospace research institutes such as NASA in US, DSTL in UK and ONERA in France play the leading roles. These are non-profit, government-run administrative technology and management organizations, equipped with high-end researchers working as civil servants. Since in Western countries the general public have access to government funding schemes for basic research, it is possible for a large number of private research-oriented enterprises to become involved in the aircraft engine industry, and thus complement the work of public research institutions.

Direct government investment into the aircraft engine industry in Western countries include: 1) research and development of military engine technologies and products, 2) national fundamental research programs, and 3) airworthiness certification of commercial products. The majority of the funding comes from two channels: the national defense budget and the budget for fundamental research programs. On one hand, aircraft engine manufacturers obtain funding through military contracts from defense authorities. On the other hand, these engine manufactures, as well as various research institutes, also receive fundamental research funding from governmental administrative organizations, and thus substantially levels up the technological capacity of the aircraft engine industry. These large scale, fundamental research programs are usually formulated, implemented and managed by entrusted national research institutions, and participated in by aircraft engine manufacturers that play an important role in exploring cutting-edge technologies and facilitating product and technology R&D of aircraft engines of the next generation.

On the other hand, there are semi-governmental airworthiness administrative organizations (such as FAA in the US, and EASA in Europe) in charge of reviewing and monitoring commercial aircraft and engines safety, representing the public interest. Such organizations are equipped with a large number of managerial and technological personnel with profound knowledge and rich industrial expertise, and could mobilize professionals from manufacturers, universities and research institutes to participate in airworthiness technology researches, formulate effective airworthiness regulations and standards, and offer technology assistance and consultation regarding airworthiness certification to engine manufacturers. The airworthiness organizations are highly independent authorities, which are responsible for certifying and regulating commercial aircraft products based on the core considerations on public safety and environmental protection issues (noise reduction, pollutant emission control, etc.). These organizations usually have strong public credibility since their judgments and decision-making will not be swayed by government opinions.

Western governments usually do not offer direct funding to civilian aircraft engine projects. Instead, major engine manufacturers or OEMs will take into consideration demands of their clients including aircraft manufacturers, airlines and aircraft leasing companies, before they launch a product development program through self-financing/market financing programs or international co-operations, and undertake market, technological and financial risks by themselves.

As for military aircraft engine technology development in US, Britain, and France, technological support is provided by government-founded specialized research institutes. Financial support usually comes from the military in the form of contract; facilities of large-scale testing programs are directly funded and managed by either government or military organizations.

Generally speaking, the aircraft engine industry in Western countries is an integrated, market-bonded whole led by major manufacturers or OEMs, and supported by government, clients and suppliers whose roles and responsibilities are clearly defined. In particular, the large domestic market, strong export capacity, independent and well-established aircraft engine R&D system of the US give it an obvious competitive edge over the others. On the other hand, UK and France, according to their limited economic and technological strength as well as their market scale, are more dependent on the EU framework, and are making full use of resources and markets in Europe and gaining financial and policy support from their government. At the same time, they proactively take part in US national development programs, and seek for joint development programs with industrial giants such as GE Aviation and Pratt & Whitney.

3. Analysis and Reform Proposals for China’s Aircraft Engine Industry

China’s aircraft engine R&D and manufacturing system has long been exclusive and monopolistic. Problems that emerged in the planned economy era remain, such as the ambiguous division of responsibilities, rights and interests, incompleteness of multitier supplier system, and overlapping roles and unclear division of responsibilities among government, enterprises and research institutes. Compared with its counterparts in Western countries, China’s aircraft engine industrial system falls behind in the following aspects.

Extremely few Chinese suppliers of aircraft components meet EN/AS9100 (International Aerospace Quality Management System Standards). According to the “International Aerospace Quality Management Committee” statistics, as of March 2017, over 7,500 US enterprises and more than 3,800 European ones are EN/AS9100 qualified, while only about 800 Chinese suppliers passed such qualification. Furthermore, around 90% of the qualified Chinese enterprises are state-owned or defense industry companies (AVIC, AECC, COMAC), while only about 10% are from private sector.

Currently, China’s aircraft engine R&D system lacks of a national level research institution, such as e.g. NASA in US, DSTL in UK and ONERA in France, thus it is very difficult to plan and form aircraft engine technology development strategy at the national level. Apart from that, as a result of the outdated planned economy model within the aerospace industry, there are hardly any private aircraft engine research institutes in China. Within the current national research program management mechanism, it is highly impossible for private institutions to directly undertake or participate in major national aircraft engine research projects.

There are three major problems:

1) Overlapping Roles between Government and Customer

When it comes to military aircraft engine research and development, based on military needs, the engine research and development tasks are usually undertaken by designated manufacturers and research institutes as political assignments, leaving no space for market competition. In terms of commercial aircraft engine development, the government sets up projects, offers full funding and is in charge of product acceptance review. In a sense, the government is actually playing multiple roles of the clients/users (aircraft manufacturers and airline companies). Since the actual demands of the real clients are not at all considered during the product development process, there is a huge supply-demand gap, leaving the government clean up the failed projects, cover huge financial lost and constantly suffer from this vicious cycle.

2) Inefficient Management of Fundamental Research Programs

Various government research funding channels at the national level are administered by different ministries and departments, and thus there is not an unified and efficient national management mechanism. While formulation and management of research schemes in Western countries are led by professional experts and implemented by specialized national research institutes, such tasks are mostly undertaken by administrative organs in China. As a result, there is a mismatch between the funding areas, assessment criteria and funding scale on the one hand, and the actual research demands on the other.

3) Limited Airworthiness Regulation Capability

China’s aircraft engine airworthiness knowledge remains inadequate due to a big lack of professionals with advanced technological knowledge and management expertise in the civil aviation administration, making it difficult to mobilize resources nationwide or initiate productive researches and data collection projects, let alone carry out exchanges and cooperation with international institutions such as FAA and EASA.

Successful practices in Western countries such as US, UK and France as well as over 60 years of exploration in China reveal to us that, the fundamental solution to revitalizing China’s aircraft engine industry lies in a market-oriented national mechanism that comprises three basic elements: 1) a market-based aircraft engine industrial system, 2) a well-established fundamental research system, and 3) a mature sector management and operational mechanism. To this end, following suggestions are proposed:

The government is supposed to lead and facilitate the restructuring of state-owned aircraft engine enterprises, to set up modernized enterprise-management mechanism and market-oriented operation mechanism, to bring in professional experts from abroad or even other sectors in China, to formulate efficient and feasible development plans and targets for the enterprises, to coordinate the sharing of intellectual property, data and resources between the military and the commercial sectors, and to substantially enhance technologies and market competitiveness of the industry.

Apart from the state-owned major manufacturers or OEMs, it is necessary to build another pillar of research and development of China’s aircraft engine by stimulating development of private manufacturers and manufacturers with mixed ownership. Well-established entities from the private sector should be encouraged to share or hold equities of major engine manufacturers as well as component and system suppliers. We shall carry out overseas mergers and acquisitions and risk-sharing projects to bring in advanced technologies and management systems from Western countries, and then study, analyze, internalize and apply such good practices so as to increase the independent technology and product development capability of Chinese aircraft engine enterprises.

Based on the scale and features of the military/civil aircraft engine and gas turbine market in China, it is desirable to set up a well-functioning, market-oriented competition environment with 2 to 3 major manufacturers or OEMs, and hundreds of second- and third-tier component and system suppliers, through restructuring state-owned enterprises and supporting private supplier programs.

We should build an inclusive supplier system that is led by major engine manufacturers or OEMs, focuses on market demands from both China and abroad, and abides by international standards such as EN/AS9100 and NADCAP. At the same time, a level playing field with fair competition mechanism should be established by breaking industry barriers and encouraging contribution from private enterprises and foreign-invested enterprises. Government-funded projects, including military aircraft engine projects, commercial aircraft engine technology development projects and pre-research projects, should abide by the principles of fairness, impartiality and openness in their bidding programs to encourage the best players and push the least developed ones out of the market. By doing so, we would be able to develop a couple of well-recognized, well-established leading aircraft engine OEMs with international competitiveness.

The government should be responsible for formulating management policies, laws and regulations in the aircraft engine industry. It shall guide and facilitate suppliers at all levels to obtain professional consultations and qualifications from international organizations. Any entity, no matter state-owned or private, intending to work independently to acquire such services and qualification, shall be entitled to the same funding, policy support, and assistance from the government. At the same time, we should encourage joint-operation between qualified foreign enterprises and their Chinese counterparts, so as to cultivate a number of qualified and competitive suppliers in raw material fabrication, part manufacturing, special processing, testing as well as technical services in a relatively short period, and therefore strengthen the country’s overall supplying systems of aircraft engine design, R&D, testing, manufacturing, maintenance and technical consultation.

Establishing an independent national aircraft engine research institute is of great importance for formulating overall research plans and guidelines. We should refer to good practices and experience of the US, UK and France when building such a non-profit organization funded and directly managed by the government. Such an institution should fulfill the following three major functions:

1)Draw up national top-level strategy for development of aircraft engine R&D programs;

2)Serve as an intelligent tank to facilitate government decision-making: demonstrating, producing and implementing research plans for major fundamental and pre-research programs, and to provide technology guidance to leading enterprises, suppliers, universities and other research institutes.

3)Undertake a large number of prospective and basic researches funded by the government and have all the findings shared by enterprises, universities and research institutes, and to share its other scientific and research resources with the public, so as to make full use of the state investment into this industry.

We shall honor the spirits of scientists, like Academician Qian Xuesen, who devoted themselves to research and development of the first atomic bombs, hydrogen bombs and man-made satellites “two bombs & one satellite” in China in the 1960s, and learn from their experience. It is recommended that we bring in high-end technological and managerial personnel with excellent capacity and profound knowledge from countries with a strong aerospace industry, and help them participate and even play a leading role in starting aircraft engine enterprises, formulating top level design, undertaking project researches and managerial tasks. We need to build project management and technology teams based on good operation and management models of industrially-advanced countries to support aircraft engine R&D in China. This would help ease the pressure caused by a lack of high-end professionals within China, and at the same time render us an effectual way to break through oversea technology barriers.